Goldman Sachs, one of the biggest names in investment banking, is making headlines once again, but not for its financial achievements. Instead, the company is in the news due to plans to lay off around 1,300 to 1,800 employees. This comes as part of a larger trend we’ve been seeing in both the financial and tech industries, where companies are cutting jobs to save money and stay competitive. This article will look at Goldman Sachs layoffs, what it means for the workers affected, and how it fits into the larger picture of job trends in the financial and tech worlds.

Why is Goldman Sachs Cutting Jobs?

Goldman Sachs’ layoffs aren’t just about trimming a few underperforming employees, as they sometimes do during their annual reviews. The scale of these cuts—up to 1,800 workers—suggests something bigger is at play. So, what’s going on?

One of the biggest reasons is a slowdown in dealmaking activity. Investment banks like Goldman Sachs make a lot of their money by helping companies merge, acquire other businesses, or raise funds through stock offerings. However, due to a tough global economy—marked by rising interest rates, inflation, and geopolitical tensions—companies are hesitant to make big moves right now. This means fewer deals are happening, which hurts banks’ bottom lines. When revenue falls, companies often look for ways to cut costs, and unfortunately, this usually leads to layoffs.

Another key factor is the growing use of technology in banking. Automation, artificial intelligence (AI), and other tech solutions are becoming more common in the financial world. These tools can do some of the work that employees used to handle, which reduces the need for as many staff members. As Goldman Sachs and other banks adopt these technologies, they often find themselves cutting jobs, especially in areas where work can be automated.

How Will These Layoffs Affect Workers?

For the employees at Goldman Sachs, these layoffs come as a major blow. While the company regularly lets go of workers as part of its annual review process, this year’s cuts are much larger than usual. And given the current economic uncertainty, finding new jobs won’t be easy for many of those affected.

Goldman Sachs’ high-performance culture also adds to the pressure. Even top performers could be let go in this round of layoffs, which makes it even more unsettling for workers. Many of the employees who are laid off may find themselves competing for a limited number of jobs in an industry that’s already feeling the strain of economic challenges.

On a broader scale, this move by Goldman Sachs is part of a trend across the entire financial sector. Investment banks are facing new challenges, including competition from fintech companies, which are smaller, more flexible, and often better equipped to take advantage of technological advances. As these new competitors emerge, traditional banks are being forced to cut costs and make tough decisions about where to invest their resources, which often results in job cuts.

How Goldman Sachs Layoffs Are Connected to the Broader Tech Layoffs?

The layoffs at Goldman Sachs are not happening in isolation. There’s a connection between what’s happening in banking and what’s happening in the tech industry. Over the past few months, several big tech companies—including Amazon, Meta, and Google—have announced their own rounds of layoffs. These tech layoffs are the result of slowing growth, rising costs, and shifting priorities in a post-pandemic world.

Goldman Sachs and other banks have become more reliant on technology in recent years. Automated trading systems, AI-powered analytics, and digital platforms have become essential for financial institutions to stay competitive. But as tech companies themselves start laying off workers, banks could find it harder to attract and retain the top tech talent they need.

The tech layoffs may even make it tougher for banks to keep innovating. If tech companies are cutting staff, it might be harder for financial institutions to hire skilled engineers and developers who can help them build out the new systems they need to stay ahead. This could slow down some of the progress banks have been making with digital transformation.

What Does the Future Hold for Jobs in Banking and Tech?

There are a few key trends to keep an eye on when thinking about how these layoffs will shape the future of work in both industries.

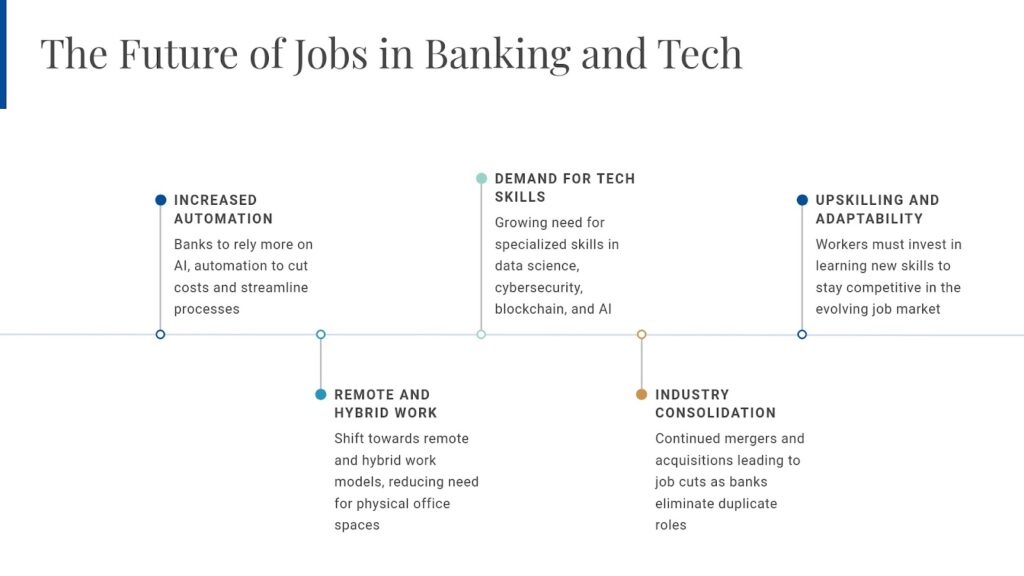

1. More Automation, Fewer Jobs

Automation isn’t going away—in fact, it’s only going to become more common. Banks are always looking for ways to do more with less, and automation is one way they can cut costs. Tasks like data entry, transaction processing, and compliance work are particularly vulnerable to automation. This means fewer people will be needed for these roles in the future.

However, there is some hope for workers. Banks will still need tech-savvy employees who can manage these automated systems and ensure they run smoothly. So, while traditional jobs may disappear, new opportunities could open up for workers with the right skills.

2. The Shift to Digital and Remote Work

The COVID-19 pandemic changed the way we all work, and the banking sector is no different. Goldman Sachs, like many other companies, has adapted to remote work. The company is investing more in digital tools and infrastructure to support a workforce that splits time between home and the office.

But as more companies embrace remote work, there may be less need for physical office spaces and the jobs that support them. This could lead to more layoffs, particularly for roles related to managing and maintaining office environments.

3. Demand for Specialized Tech Skills

As banks become more reliant on technology, there will be a growing demand for specific tech skills. Data science, cybersecurity, blockchain, and AI are all areas where financial institutions will need experts. For tech workers affected by layoffs in the tech industry, this could be an opportunity to shift to the financial sector.

At the same time, competition for these tech-savvy workers will heat up, as both banks and traditional tech companies try to hire the best talent. For workers with the right skills, this could mean better pay and benefits as companies compete for their expertise.

4. Mergers and Consolidation in the Industry

Consolidation in the financial services industry is another trend that’s been gaining steam. Smaller firms are being acquired by larger players, which often leads to layoffs as the merged companies eliminate duplicate roles. This trend is expected to continue, especially as economic challenges put pressure on smaller banks to sell or merge.

While consolidation often leads to job cuts, it can also create new opportunities. As banks grow through mergers, they may need workers who can help them integrate new businesses and expand into new markets.

What Should Workers Do to Prepare?

For employees in the financial and tech sectors, the recent wave of layoffs is a reminder that the job market is constantly changing. Workers who want to stay competitive will need to be flexible and ready to adapt to new trends and technologies.

One way to do this is by upskilling. Employees who invest in learning new skills—especially in areas like data science, AI, and cybersecurity—will be better positioned to take on new roles as the job market evolves. Those who can navigate these changes will find themselves in demand, even as automation and consolidation continue to reshape the industry.

Conclusion:

The Goldman Sachs layoffs are a wake-up call for the entire financial services industry. As banks face new economic challenges and the increasing need to adopt technology, we can expect more job cuts in the future. But while layoffs are difficult, they also present opportunities for workers to reinvent themselves and pursue new paths.

For Goldman Sachs and other banks, the future will involve balancing the need to cut costs with the need to stay competitive in a rapidly changing market. The banks that can embrace technology and adapt to these changes will be the ones that thrive. And for workers, staying ahead of these trends and learning new skills will be the key to long-term career success.

As both the financial and tech sectors continue to evolve, it’s clear that the job market will never be the same. Workers who stay flexible, adaptable, and ready to embrace new technologies will be the ones who succeed in this new era. Sign-up with JobsPikr to understand the job market trends.