The U.S. job market, like most economies, is continually impacted by various external economic factors. Inflation rates, unemployment figures, GDP growth, interest rates, and government policies each profoundly affect the hiring landscape. Understanding these variables helps companies, job seekers, and policymakers navigate job market fluctuations and anticipate sectoral hiring trends. JobsPikr’s data from recent U.S. employment trends sheds light on how these factors shape job openings, revealing invaluable insights for businesses and job seekers alike.

External Economic Factors Shaping the Job Market

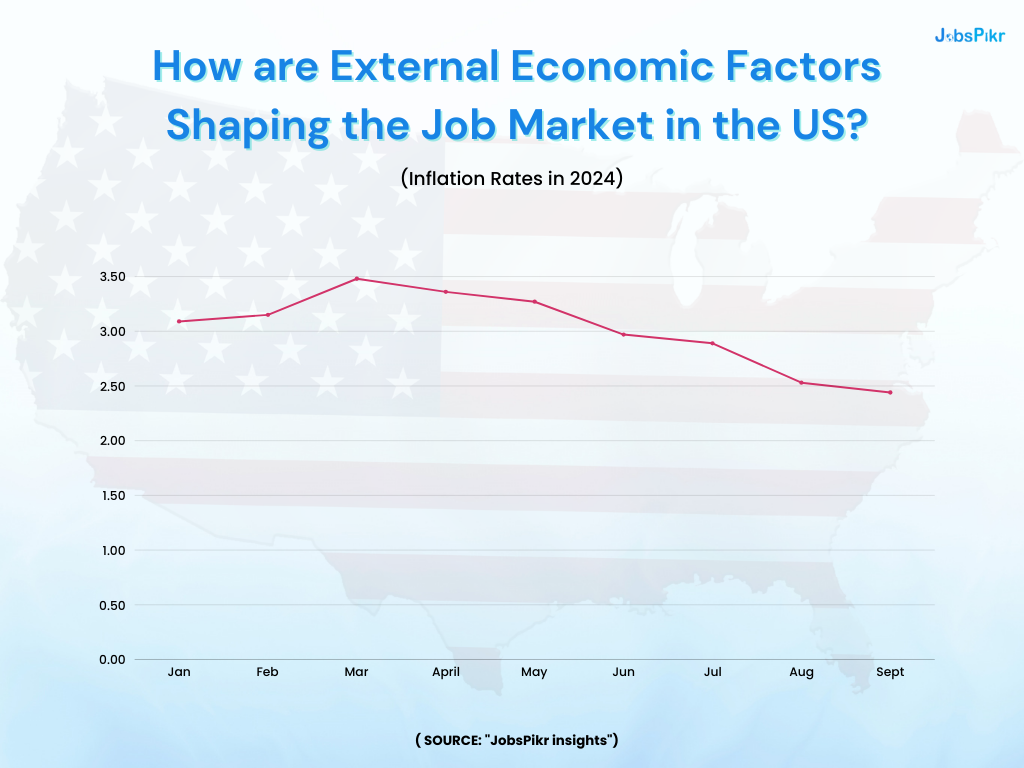

Inflation Trends Over Time

Inflation is a key economic indicator that directly impacts consumer spending and, by extension, hiring across industries that depend on discretionary income. In 2024, inflation in the U.S. has shown a downward trend, decreasing from a high of 3.48% in March to 2.44% in September, according to data from YCharts. As inflation moderates, consumers regain purchasing power, which often translates into higher spending in sectors such as retail and hospitality. These industries, which rely on robust consumer spending, can expect a gradual uptick in demand and job creation as inflation stabilizes.

Retail, for example, experienced a reduction in job openings from 5.77 million in 2023 to 5.2 million in 2024, possibly due to the effects of higher inflation earlier in the year. However, with inflation cooling, this trend could reverse, leading to renewed hiring and a boost in employment as consumer confidence recovers. Stabilized inflation also supports steady operational costs for businesses, reducing the pressure on wages and encouraging firms to invest more confidently in workforce expansion.

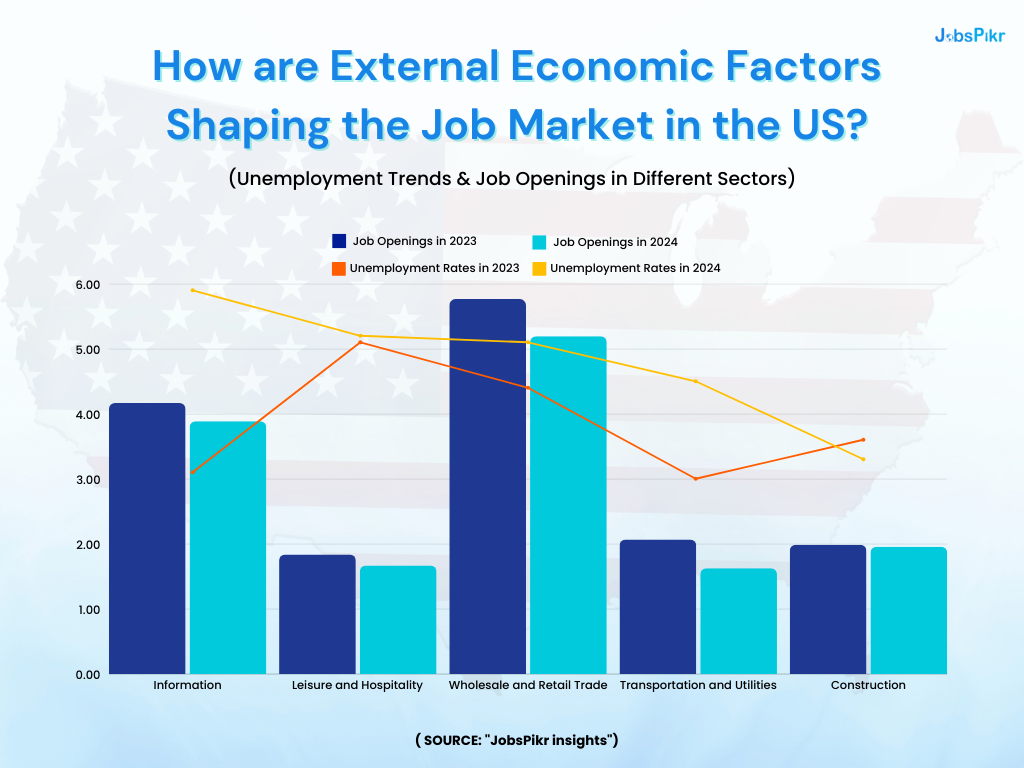

Unemployment Trends by Sector

Sector-specific unemployment rates provide deeper insights into labor market dynamics across various industries, revealing how each industry uniquely reacts to economic pressures. According to Oberlo, certain sectors experienced marked increases in unemployment rates from June 2023 to June 2024. The information sector, for instance, saw unemployment rise from 3.1% to 5.9%, a trend that coincides with a reduction in job openings from 4.17 million in 2023 to 3.89 million in 2024. This shift likely reflects market corrections, technology consolidations, and possibly increased caution in hiring due to economic uncertainties.

Similarly, sectors such as transportation, wholesale trade, and utilities experienced increases in unemployment, with rates rising from 3.1% to 4.5% in transportation, mirroring declines in job openings in response to economic shifts. Conversely, construction witnessed a slight decline in unemployment, from 3.6% to 3.3%, signaling resilient demand for skilled labor within the sector, likely fueled by ongoing infrastructure projects and housing developments. Sector-specific unemployment data serves as a vital tool for understanding which industries are thriving or contracting, and it highlights the economic sensitivity of sectors like information technology and transportation to macroeconomic fluctuations.

GDP Growth and Hiring Trends

Gross Domestic Product (GDP) growth is a crucial driver of employment, as economic expansion generally stimulates job creation across a variety of industries. In Q2 of 2024, the U.S. reported a GDP growth rate of 3%, underscoring strong economic performance, as per U.S. Bank. This growth has had a ripple effect on employment, particularly in consumer-driven sectors like food services and government. When GDP rises, these sectors benefit from increased consumer demand and higher government spending, leading to a surge in job openings as businesses and public sector institutions expand to meet rising demand.

However, GDP growth is not always consistent, and its fluctuations have a tangible impact on hiring trends. When GDP growth slows or becomes unpredictable, companies may shift their focus from hiring to capital expenditures, investing in technology or equipment to optimize operations instead of expanding the workforce. This caution is often seen in cyclical sectors, such as manufacturing, where employment is closely tied to economic cycles. Understanding GDP’s influence on hiring helps businesses anticipate shifts in labor demand and make data-driven decisions about workforce planning, particularly in more volatile sectors like retail and manufacturing.

Interest Rates and Sectoral Impacts

Interest rates are a significant economic variable that affects industries reliant on financing and consumer spending. Rising interest rates increase borrowing costs, making it more expensive for businesses and consumers alike to finance large purchases. In sectors like construction and real estate, where financing is crucial for growth, high-interest rates can slow down job creation. With loans becoming costlier, fewer construction projects are initiated, and consumer demand for real estate diminishes, reducing job openings in these areas.

The construction industry, for example, saw job openings decline from 1.99 million in 2023 to 1.96 million in 2024, reflecting the effect of tightened borrowing conditions. Similarly, sectors like automotive, retail, and consumer goods, which are sensitive to consumer financing, may see reduced hiring as people prioritize saving over spending. This dynamic creates a feedback loop where high interest rates not only impact immediate borrowing costs but also dampen long-term job growth in industries dependent on financing. Understanding interest rates’ impact is essential for businesses as they strategize hiring and growth plans amid changing economic conditions.

Source: Yahoo Finance

Government Spending and Policy Changes

Government spending and regulatory shifts play a substantial role in shaping job markets, especially in sectors like energy, healthcare, and technology. One notable trend is the growing emphasis on clean energy initiatives as governments worldwide commit to achieving climate goals. The International Energy Agency (IEA) reports that since 2020, global governments have allocated over $2 trillion toward clean energy investments, with policies such as the EU’s Net Zero Industry Act driving demand for renewable energy jobs. These investments have spurred employment in fields such as renewable energy, battery manufacturing, and green hydrogen production.

For the U.S., policy-driven funding towards clean energy has led to job creation in energy technology and infrastructure, with strong hiring demand projected as clean energy targets and climate policies advance. In healthcare, regulatory shifts and government-funded programs similarly drive demand for specialized roles. As government spending continues to rise in targeted sectors, businesses are likely to see new opportunities for expansion and job growth, even in traditionally slower-growing industries. JobsPikr’s data reveals how these policy shifts contribute to long-term employment trends, providing valuable insights into how government actions affect the demand for skilled workers across sectors.

Conclusion

In a rapidly changing economic landscape, external economic factors such as inflation, interest rates, GDP growth, and government policies remain critical influences on U.S. employment trends. By understanding these variables, businesses and job seekers can better navigate shifts in labor demand and make informed decisions.

JobsPikr’s job data insights offer a window into these dynamics, providing actionable intelligence for industry stakeholders to adapt to evolving market conditions.