The job posting volumes in a sector can act as an early indicator of economic health and labor market trends. In times of growth, job postings typically surge as companies expand; during periods of contraction, a decline in listings may indicate hiring freezes or slowdowns.

With data from JobsPikr and Intellizence, this article explores the hiring landscape in 2024 across the automotive, banking, and retail industries and highlights how job postings reflect broader economic dynamics.

Job Posting Volumes: Industry-Wide Indicators

Tracking job posting volumes offers valuable insights for both businesses and job seekers. Companies can anticipate shifts in talent demand, while individuals can make informed career moves by understanding industry health.

Automotive Industry: A Mixed Landscape of Layoffs and Hiring

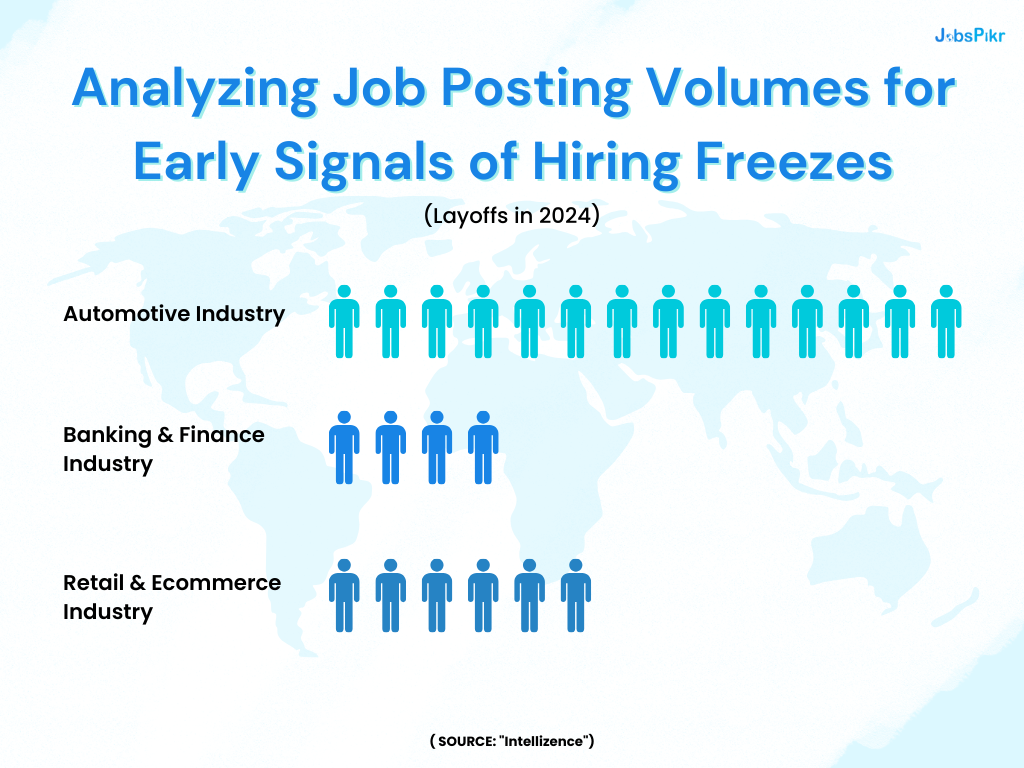

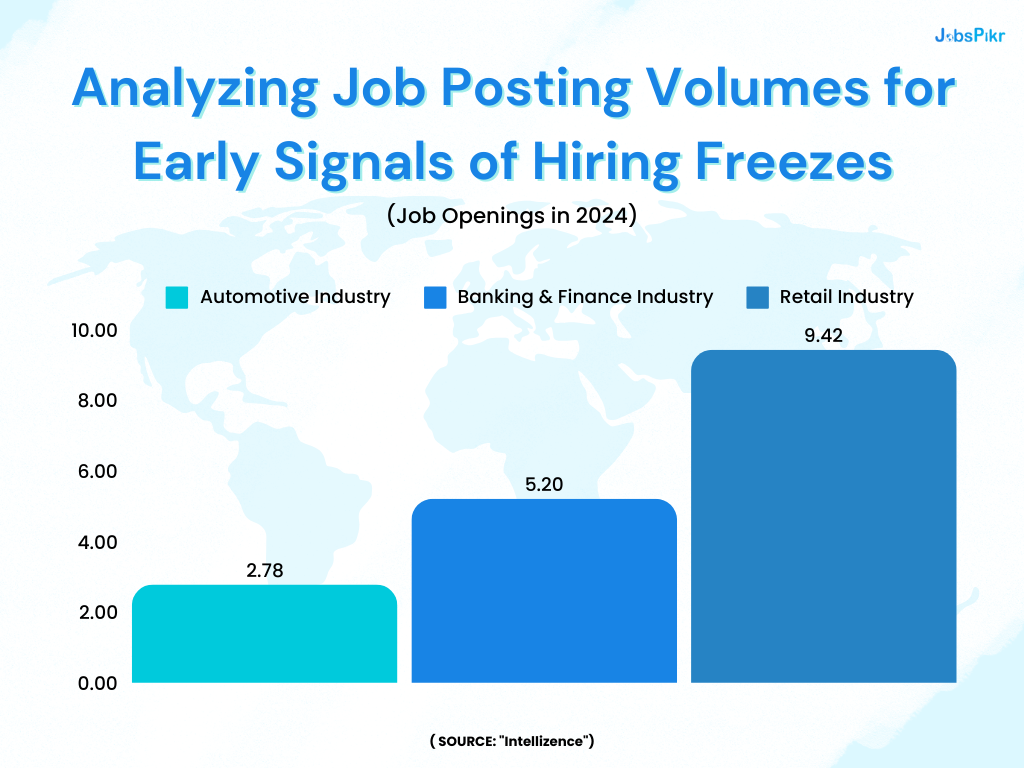

Layoffs in the automotive sector this year reveal significant downsizing among major players. According to Intellizence data, companies like Nissan, Bosch, and Tesla have announced layoffs affecting thousands of employees, totaling 27,415 across the sector. Despite these layoffs, JobsPikr data shows that the automotive industry had 2.78 million job openings from January to October 2024, with companies such as Volkswagen AG, JB Poindexter & Co, and AutoZone leading in hiring.

Data Insights:

- Top Hiring Companies: Volkswagen AG (74.4K), JB Poindexter & Co (65.2K), and AutoZone (56.7K) are actively hiring to meet specific demands.

- Layoffs Data: Nissan (9,000 layoffs) and Tesla (6,020 layoffs) demonstrate the sector’s selective restructuring approach, balancing workforce reduction with targeted hiring for critical roles.

Banking & Finance Industry: Balancing Expansion and Caution

The banking and finance industry had over 5.2 million job postings in 2024, signaling active hiring needs. Leading employers include Penny (244K openings), Mosaic Group (147K), and Wells Fargo (98K). However, layoffs from Santander (1,400), Visa (1,400), and PwC (1,800) point to an underlying caution in the industry, perhaps a response to fluctuating economic conditions.

Data Insights:

- Top Hiring Companies: Penny, Mosaic Group, and Wells Fargo are among the top employers in 2024.

- Layoffs Data: Despite continued hiring, companies like Intesa Sanpaolo and PwC US are reducing headcounts, indicating a selective approach to growth amidst financial uncertainty.

Retail and E-commerce: High Demand but Selective Restructuring

With 9.42 million job openings posted in 2024, the retail sector remains a significant contributor to the job market. Top employers include Walmart (713K openings), Lidl US (658K), and REWE (552K). However, layoffs from Amazon (2,900) and Estee Lauder (3,100) suggest a strategic realignment in workforce management.

Data Insights:

- Top Hiring Companies: Walmart, Lidl US, and REWE have consistently shown robust hiring patterns.

- Layoffs Data: With 8,740 combined layoffs in 2024, companies like Amazon and LL Flooring are cautiously restructuring while maintaining a strong hiring outlook.

Why Job Posting Volumes Matter for Economic Insights

Job posting volumes offer more than just hiring insights; they serve as valuable economic indicators. For instance, a sharp decline in listings across multiple sectors may signal economic slowdowns, while increases might indicate growth and expansion. The fluctuations in the volume of job postings, when paired with data on layoffs, provide a comprehensive view of industry health, allowing stakeholders to forecast trends and make data-driven decisions.

Conclusion

By examining the interplay between job posting volumes and layoffs, businesses and job seekers alike can glean valuable insights into current market conditions. Whether you’re an HR professional seeking to understand hiring trends or a job seeker strategizing your next move, analyzing job data can offer a competitive advantage in a rapidly changing economy.

For more such insights, sign up to JobsPikr.

Sources:

- Layoff data from Intellizence

- Job openings data from JobsPikr